Bank of England set to hike rates

The Bank of England is poised to raise borrowing costs again on Thursday to combat stubbornly high inflation, which has failed to come down from its peak as quickly as expected.

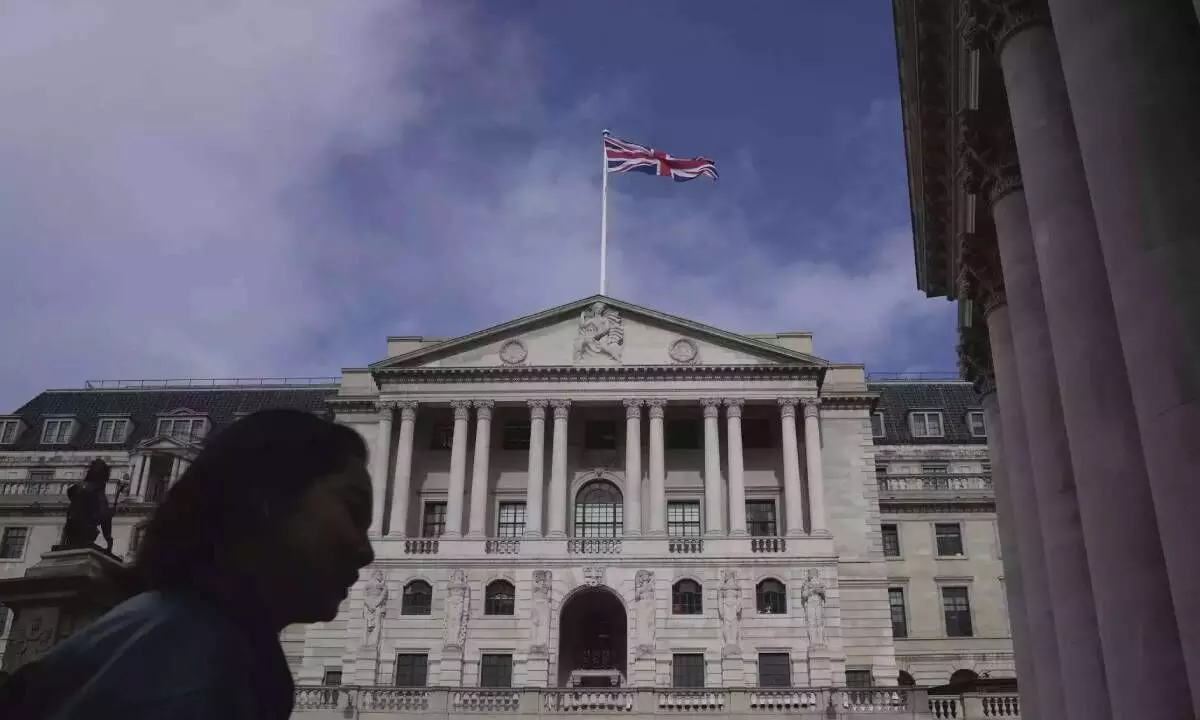

image for illustrative purpose

London The Bank of England is poised to raise borrowing costs again on Thursday to combat stubbornly high inflation, which has failed to come down from its peak as quickly as expected.

Though the consensus among analysts is that the central bank will raise its main interest rate by a quarter-percentage point - hitting a new 15-year high of 4.75 per cent - there are concerns, certainly among borrowers, that it may opt for a bigger half-point increase. That larger hike would be particularly painful for people with loans, especially the 1.4 million or so households in the UK that will have to refinance their mortgages over the rest of the year. Central banks around the world, from the US Federal Reserve to European Central Bank, have been rapidly raising interest rates to bring down inflation first stoked by supply chain backups tied to the rebound from the pandemic and then Russia's invasion of Ukraine.